Regulatory Change Management

Transform the way you manage compliance with Automated Regulatory Intelligence.

Sharp rise in regulatory change management pressures

The growing volume and complexity of regulatory changes poses challenges for firms

relying on manual monitoring and management of regulatory inventories.

Regulatory professionals often grapple with overseeing the end-to-end change process

across multiple disparate systems and tools,

leading to difficulties in task monitoring and an increased risk of missing critical obligations.

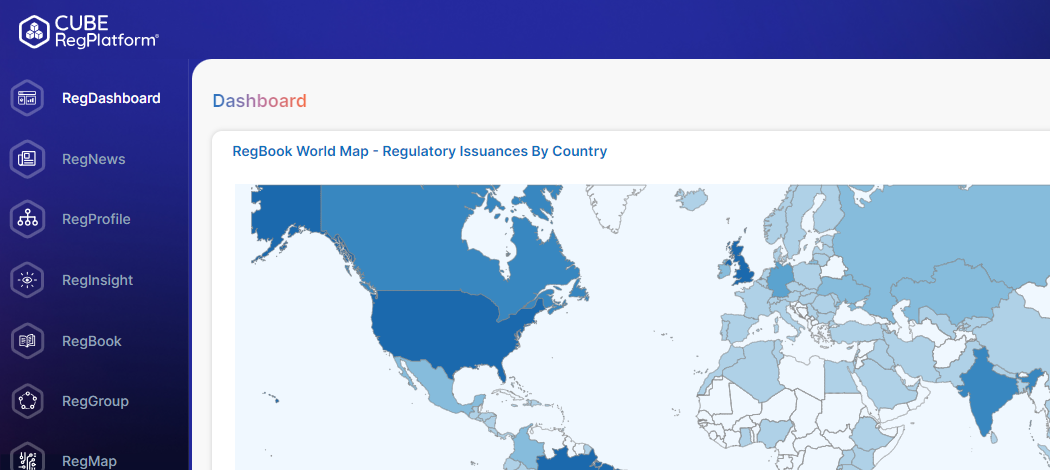

Mission critical regulatory change solutions

Proactive businesses are looking to automated solutions to manage the entire end-to-end regulatory change management journey. With CUBE RegPlatform, businesses can be equipped with the right tools to navigate even the most volatile economic environment, without ever missing a relevant law, rule or regulation.

CUBE covers the entire regulatory change lifecycle

CUBE’s compliance solution uses AI and machine learning to automate the entire end-to-end compliance process. Get access to what is relevant, what has changed and what you need to action through Automated Regulatory Intelligence.

Get in touch

We always strive to listen and value feedback. If you have any questions, suggestions or would like to explore our Automated Regulatory Intelligence solutions, don't hesitate to get in touch. Our dedicated team is here to assist you.