Amanda Khatri

Editorial Manager

Moving away from manual to AI for regulatory change management

Technology is constantly changing to become more efficient, accurate and capable. The hype around Artificial Intelligence (AI) has skyrocketed, whether it’s voice recognition, marketing chatbots, or self-driving cars and robots.

AI is defined as the simulation of human intelligence processes by machines, especially computer systems. In other words, any manual tasks a human can do can also be completed by a machine.

On 1 October, Tesla’s co-founder and leader, Elon Musk showed the world its humanoid robot, Optimus, at a Silicon Valley event where it waved to the audience and performed a hands-in-the-air dance. Although it’s still in its early stages of development, the robot was created to help with basic tasks such as watering plants, carrying boxes and moving objects. AI is truly limitless and will only expand further as we realise the potential that it brings.

TechJury recently reported some interesting statistics for AI:

- By 2023, AI-powered voice assistants are expected to reach 8 billion.

- By 2025, the global AI market is expected to be almost $60 billion.

- AI to increase business productivity by 40%.

- 77% of the devices we use feature one form of AI or another.

These statistics emphasise that the current and projected popularity of AI is massive. The future is digital.

How is AI used in the financial sector?

Every sector has a set of regulations to follow, and the financial sector is no different. There are numerous AI use cases such as risk management, personalised banking, fraud detection, and of course, regulatory change management. There is also machine learning (ML) which is an application of AI which permits computers to learn without being given instructions so that it can improve based on a trial-and-error experience to form its own algorithms.

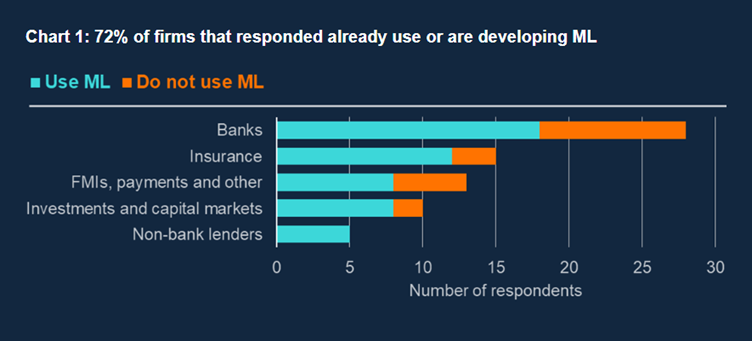

In a recent survey conducted by the Bank of England (BoE), which sought to explore machine learning within financial services, the BoE found that 72% of survey respondents reported using or developing ML applications and this number is projected to increase by 3.5 times over the next three years. These are the business areas ML is widely used in:

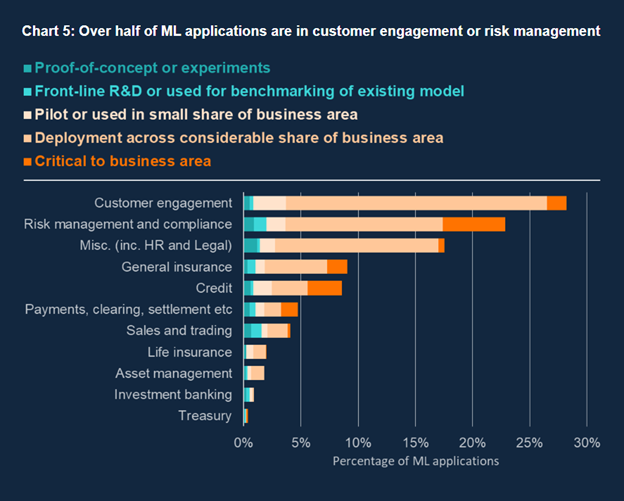

As you can see in the graph below, the second-highest application of ML is in risk management and compliance, with the highest percentage of ‘critical to business area’ applications. This portrays that risk management and compliance regulations are vital to businesses when utilising AI.

Because of technological advancements and innovation, there are constant changes to regulations – this includes modifications to existing laws as well as new regulations. These alterations put a burden on compliance teams who then need to identify relevant regulations, implement them into change management processes and ensure the firm and its employees are behaving accordingly. Failure to comply can be detrimental such as fines, reputational damage, losing ground to a competitor and even imprisonment in some cases.

To ease compliance burdens, firms have turned to AI. Automated Regulatory Intelligence (ARI) uses AI to power your regulatory change management processes. It streamlines regulations, simplifies them and provides a highly intelligent process for capturing and managing regulatory changes.

What did financial institutions do before AI for regulatory change?

Before AI, financial institutions previously managed regulatory change using manual processes. These took a long time a long time and are prone to gaps and vulnerabilities. Compliance teams would trawl through numerous regulatory sites (even more if they operated in multiple jurisdictions) to check for new regulations or any changes to current laws.

These would then be recorded within a spreadsheet (or similar) and then fed into their policies, controls, and procedures. Manual scrolling on the internet does mean that firms could easily miss a regulation, which could be detrimental as a breach is more likely. While most firms have moved away from manual processes, rumour has it that some continue to use Excel spreadsheets.

Manual trawling not only slows down growth due to its time-consuming process; in the instance of a breach, it can also take time, stress and energy for an entire firm to recover and reassess any rapid growth plans.

If a regulatory body asked to see a firm’s audit trail e.g. who is doing what and where, it would also be more difficult to identify the policies already in place as tracking regulations on a spreadsheet is inefficient. Therefore, the manual process of managing regulatory change doesn’t empower compliance professionals.

How AI can simplify regulatory compliance

Studies show that on average there are over 200 regulatory alerts every day. It was found that in 2021 alone, there were over $5 billion in fines in the financial services industry.

RegTech was created to solve the very compliance issues that lead to these repercussions of non-compliance. In an ever-changing regulatory landscape, automating the change management process ensures that a firm has watertight frameworks in place, adhering to the correct regulations.

Automated Regulatory Intelligence (ARI) which is another way of saying RegTech, helps corporations proactively and effectively manage regulatory changes. It allows you to plan for the future and implement changes before regulation comes into play.

Not only does this increase confidence for compliance teams by empowering them to make informative compliance decisions, but it also provides your firm with a competitive advantage over other companies that may have not followed the right regulations – setting up themselves for non-compliance. And a consumer would always rather do business with a compliant company over one that is not!

CUBE has been building RegTech solutions for compliance issues for over 10 years. Our RegAssure product is perfect for businesses looking to grow as it can help to distinguish relevant obligations. It creates rulebooks using information from over 5,000 issuing bodies and standardises it into one virtual rulebook which is easy to use and navigate.

By implementing RegAssure, your firm can benefit from the following:

- Mitigate compliance risks and ensure watertight systems.

- Overall operational efficiency.

- Easier, quicker and more effective compliance processes – over time, benefit from a higher return on investment.

- Improve combatting money laundering and fraud.

- Accurate translation for up to 60 languages into English.

CUBE comment

Moving away from manual processes is becoming a more regular phenomenon. From entering your pin into a card reader to contactless payments and staff at supermarket tills to digital self-checkouts. Ultimately, replacing all tedious and time-consuming manual processes which allow humans to focus on more high-value tasks.

ARI is doing exactly that. It is replacing the timely, manual process of analysing various regulations to ensure operational efficiency so that compliance teams can refocus their energy on planning ahead and compliance strategy. With RegTech, firms can automate this process and ensure they receive the regulations that matter most, all in one place in real time.

Interested in hearing more about our integrated online platform for regulatory change management? Get in touch below.